Real estate expert says UAE real estate’s current slowdown should be seen as a minor correction than a major crash.

David Dudley, international director at JLL MENA, said that the while the impact of reduced oil prices on the economy will lead to a short-term slowdown in demand, this is occurring at a time of minimal supply completions leading to relatively stable market conditions.

He said: “The market experienced a major upswing from 2013 to 2014, led by the residential sales market, with prime residential prices growing at 25% per annum. This pace of growth was unsustainable.”

“The current phase is a slow-down and a relatively minor correction, rather than a major crash – with reduced supply coming through at a time of weak demand, allowing underlying dynamics to catch up with the pace of value growth.”

Dudley argued that while liquidity has tightened, funding is still available for project finance and corporate level lending – it is just more selective. “The good news is that demand growth continues from projects that started when oil prices were strong.”

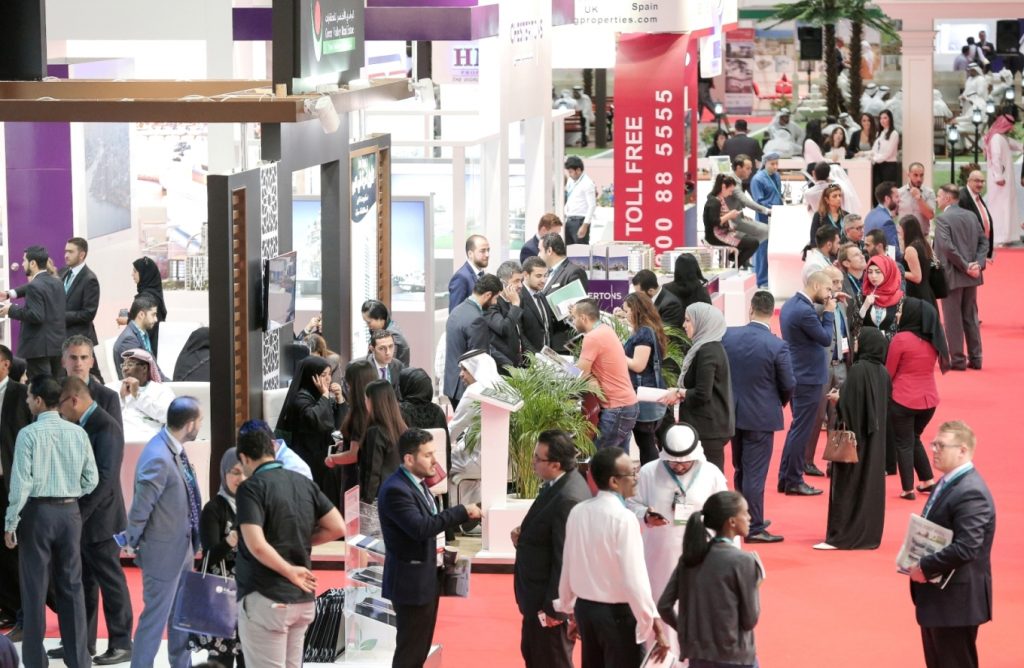

Dudley will be participating in the Abu Dhabi Market Overview, which runs on the opening day of Cityscape Abu Dhabi which will take place at the Abu Dhabi National Exhibition Centre from 12-14 April 2016.